Trends in Retail: How Increased ABV Offers an Opportunity For Retailers

In our recent webinar – How to win in the current retail climate: exploring digital strategies for success – Andy Mulcahy, Strategy and Insight Director at IMRG, joined our own Chris Liversidge, CEO at QueryClick, to discuss the state of online retail in the wake of Brexit, the pandemic, the war in Ukraine and the cost of living crisis.

Here is a quick synopsis of what Andy was able to share with us from trends identified in the IMRG data.

An unprecedented landscape for online retail right now

There is a tendency in online retail, Andy explained as he opened the webinar, to focus in on what are the latest disasters afflicting the sector. And that the sector as a whole tends to like ‘a good moan’.

But there is little doubt that the past few years have presented a range of challenges and issues that are relatively unprecedented in nature. Initially there was the uncertainty around Brexit which then led directly into the biggest global pandemic in over 100 years – with all of the knock-on effects of stockpiling and goods being stuck in ports across the globe. And, more recently, just as we were beginning to emerge from the shadow of those events retail has been hit by the impact of the war in Ukraine. Which has only served to turbocharge a cost-of-living crisis that was always going to be a factor in 2022.

So, what has been the impact of all of this on the online retail sector?

And what does the IMRG data from their panel of 200 retailers and annual spend of £28bn tell us about the state of play?

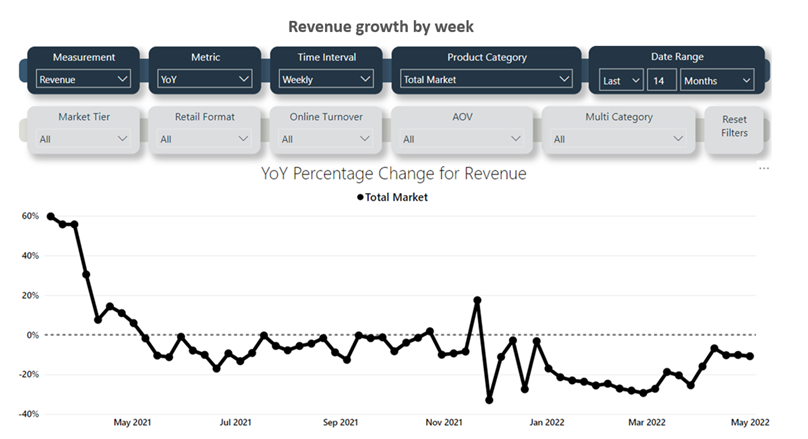

Pandemic growth levels in spend were followed by huge falls

The graph below shows Revenue Growth which goes back over a 14-month period. On the left-hand side, you are able to see the skyrocketing levels of growth of up to 60% that were being experienced during the pandemic. This was driven largely by pandemic conditions which meant that a significant percentage of retail buyers moved online. Out of necessity.

However, as you can see the graph drops down into negative territory more recently as revenue in relative terms comes back down and there is an element of rationalisation going on.

The challenge for online retailers is to begin to baseline things again. So, as the figures drop down from 60% it hits the first trough which was only up about 6% in a single week in April 2021. So, you would think that was a good target to set and achieve YOY except that things were down 7% for the same week YOY. A pattern that has been repeating again and again – in fact, April as a whole was 12% up last year and 12% down this year. A mirroring effect that tells you there is no growth online.

What is happening now is that the cost-of-living issue is really having a strong influence. With some very erratic spending patterns with no real rhyme or reason to why this might be the case.

The current climate is impacting consumer confidence and behaviour

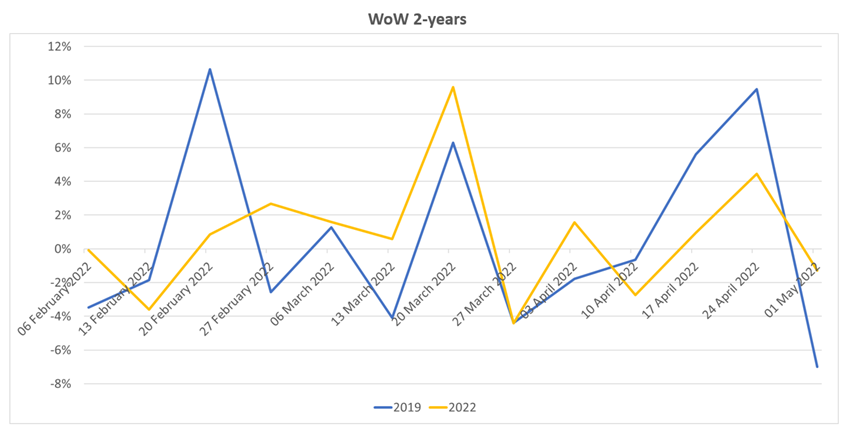

Now let’s take a look at a year-on-year comparison for the same weeks in 2019 and 2002 respectively (we have removed 2020 and 2021 as they skew things due to the impact of the pandemic).

Now what you would expect to see here are largely seasonal trends – for example events like Black Friday and seasonal summer sales will show as spikes on the graph. And you will tend to have some differences of 2 or 3% between the lines as things differ slightly year on year.

So, you do get impacts, for example if it rains for a long period when it is supposed to be sunny which has a knock-on effect on garden furniture sales, for example. But what we see in the data above is that there wasn’t the usual spike in mid to late February 2022 which corresponds with the beginning of the Ukraine War. And the same thing is happening in April which is significantly down on 2022 as both the continuing impact of the war and associated cost of living crisis impact things.

However ABV is up

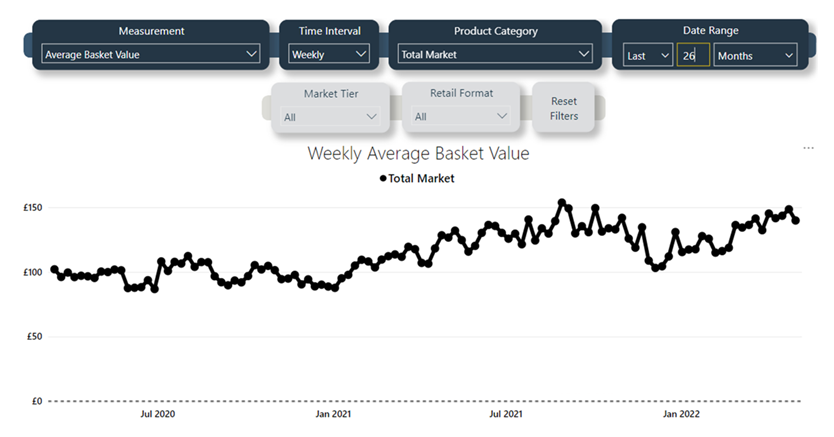

So, spend is being impacted without a doubt. But what has happened to the average spend at the checkout – in the form of ABV (Average Basket Value)?

What you are looking at above is two years of data on ABV. And the trend here is upwards with ABV in the first week of May 2022 of £146 which is:

- An increase of £20 or 16% YOY versus last year

- An increase of £40 or 37% since 2020

So why is that astronomic growth happening now? It is very complicated, and inflationary pressure is part of the equation, but it also appears that people are continuing to buy premium products rather than switching to cheaper alternatives. There also appears to be an element of bundling orders together so that people don’t have to pay twice for delivery charges.

So, inflation is a factor, but changes in behaviour also need to be factored in.

Accurate attribution is key to taking advantage of increased ABV

So, there is little doubt that recent times have been challenging in retail.

But the increase in ABV is an opportunity that online retailers can’t afford to miss.

Listen to our full webinar here as Chris explains how effective AI and Machine Learning attribution are key to unlocking the value here.

Own your marketing data & simplify your tech stack.

Have you read?

I have worked in SEO for 12+ years and I’ve seen the landscape shift a dozen times over. But the rollout of generative search engines (GSEs) feels like the biggest...

As you will have likely seen, last week Google released the March 2024 Core Algorithm Update. With it, comes a host of changes aiming to improve the quality of ranking...

After a year of seemingly constant Google core updates and the increasingly widespread usage of AI, the SEO landscape is changing more quickly than ever. With this rapid pace of...