What Does Paid Social Look Like For Retail Marketers In A Post-iOS14 World?

Paid social was turned on its head when Apple announced that from April 15, 2021 the iOS14 release would make their IDFA a required opt-in on each and every app used – striking fear into the hearts of retail marketers, most of whom were already suffering the wider impact of an unprecedented pandemic.

One of the predicted knock-on effects of the change was the impact it would potentially have on the targeting effectiveness of Facebook ads which represent a significant proportion of spend for many retailers.

We were intrigued to find out how this played out for the sector and our recent Performance Marketing Trends in Online Retail survey uncovered some startling headline stats around the experience for retailers – post-iOS14 – which we delve into below.

A picture of increased spend and declining performance post-iOS14

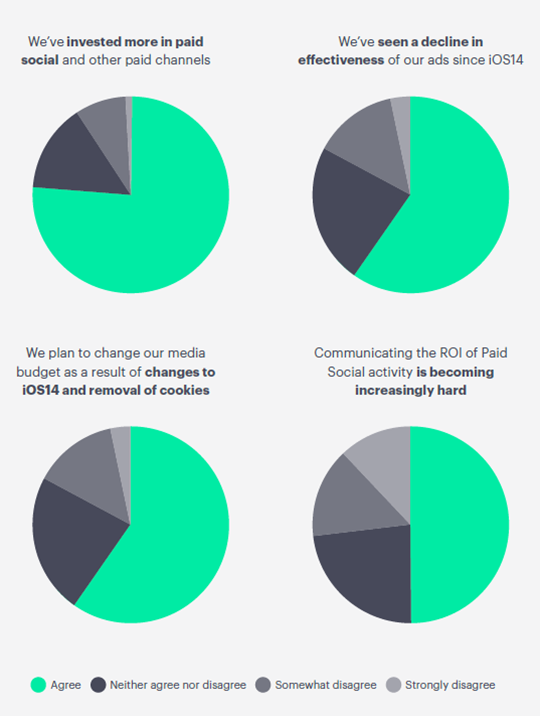

Based on an initial look at the data in our survey, it is clear that the changes around iOS14 are being felt far and wide.

In fact, 60% of respondents agree that they’ve seen a marked decline in performance and effectiveness of ads across Facebook since iOS14. This is despite 76% of respondents saying they have invested more in paid social.

From serious reductions in audience sizes, to drops in volume, to delayed reporting, to estimated results and a lack of breakdown in results to enable ad targeting. Plus, limitations in attribution window settings.

Bloomberg really weren’t overstating things when they said that advertisers were panicking about the impact on paid social – due in part to the fact that users were giving apps the right to track them just 25% of the time after the update.

The iOS14 issue is tapping into a rich vein of concern from users around privacy with recent research mirroring findings that as many as 83% of consumers expect to have control over how their data is used by a business.

Couple this with the impending changes around third-party cookies and you have a perfect effectiveness and measurement storm.

55% of our survey respondents are concerned about the effectiveness of their spend on Facebook post-iOS 14 and plan to change their budgets.

And it is worth pointing out that this issue comes hard on the heels of what is arguably one that is just as big – which is the difficulty of getting a true picture of the impact of your Facebook related spend.

It is something we touched on earlier in the research but it’s worth re-iterating here – in some ways the iOS14 issue and the removal of third-party cookies is masking the real issue. Which is that many retail marketers can’t properly assess the true impact of campaigns on paid social.

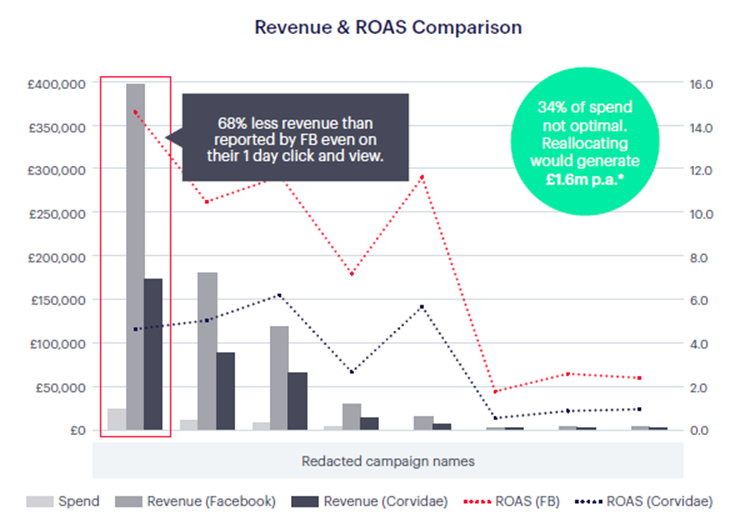

Take the client example below which is based on our work with a well-known online clothes retailer in the UK. In this case not only were Facebook reporting 68% more revenue than was properly attributed by our attribution tool, Corvidae. But an incredible 34% of spend was not optimal and Corvidae was able to identify that re-allocating it would generate an additional £1.6 million p.a.

So, perhaps there is nothing surprising in the fact that 50% are not confident in being able to accurately communicate the ROI from paid social channels.

Download a copy of the full Performance Marketing trends in Online Retail survey report which includes:

- “State of play” assessment of retail marketing

- Post pandemic trends that are influencing strategy

- Trends in SEO and social for retailers

- Impact of the death of the 3rd party cookie and iOS 14

A significant majority of retailers have an eye on social selling in future

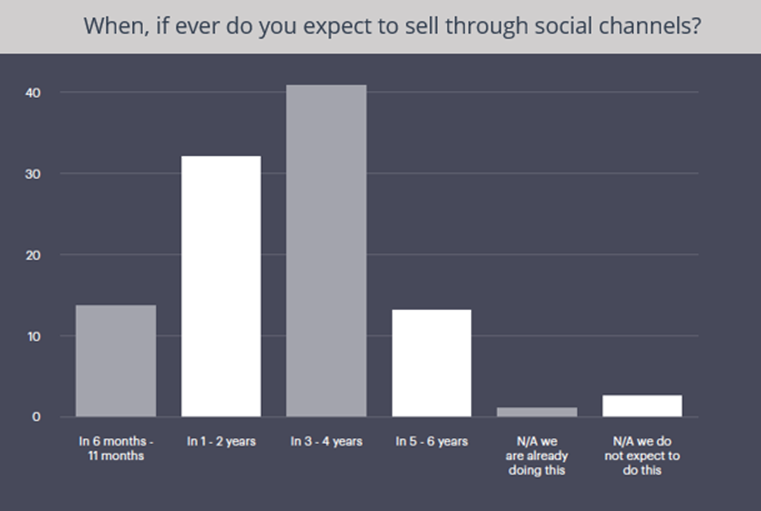

Selling direct in social media – though a powerful trend in agency circles – is struggling to get traction with many retailers.

Based on our findings it looks like this one is on the horizon only for the bulk of retailers. With 72% indicating that it is in the pipeline at some point in the next 1-4 years. A figure that increases to 82% amongst Performance Marketing Directors.

Likely due to a combination of concerns over further breaking their ownership of customer conversion, management of more shopping feeds for optimisation, co-ordination on pricing and stock. And, also, the overwhelming challenge with iOS14 and its reverberation around the profitability of social channels.

However, there is also the likelihood that this issue will be forced for retailers by the competitive effect of social networks dipping into social selling themselves.

Recent testing of ecommerce features in the European market by TikTok and similar ventures across Facebook, Instagram and Snapchat would suggest that the platforms themselves are moving in to eat some of the retailer’s lunch.

We would expect to see Social Shopping get stronger for retailers as some of the issues that are currently holding it back become trivial. Including automated feed management (already available), more accurate attribution (again already available – assuming you are using Corvidae of course!), and better campaign bid strategies which better leverage first-party data.

The declining performance of Facebook ads post-iOS14 and the potential upside in social selling are only two of the issues that retail marketers are grappling with right now.

To get the full picture – including an assessment of broader trends in SEO, the impact of competition from online marketplaces and the death of the third-party cookie – download a copy of our Performance Marketing Trends in Online Retail survey below..

Performance Marketing Trends in Online Retail

Download the full 2022 report below.

Own your marketing data & simplify your tech stack.

Have you read?

I have worked in SEO for 12+ years and I’ve seen the landscape shift a dozen times over. But the rollout of generative search engines (GSEs) feels like the biggest...

As you will have likely seen, last week Google released the March 2024 Core Algorithm Update. With it, comes a host of changes aiming to improve the quality of ranking...

After a year of seemingly constant Google core updates and the increasingly widespread usage of AI, the SEO landscape is changing more quickly than ever. With this rapid pace of...